Why APRs Don’t Work for Small Loans or Small Amount Credit Contracts (SACCs)?

An Annual Percentage Rate (or APR) is a unit of measurement for the rate charged on credit, generally expressed as a percentage. In relation to interest rates, it is representative of the yearly costs of funds over the term of a loan.

So why does APR not work for Small Amount Credit Contracts (SACCs) or small loans? Especially when a borrower wants to understand how much their small loan will cost them?

- An Annual Percentage Rate (APR) does not become meaningful until more than 12 months as it is calculated annually.

Small Amount Credit Contracts (SACCs) are payable between 16 days and 1 year – therefore there is no meaningful annual percentage rate. APR values are distorted for SACC loans, which are all repaid under 1 year. - An independent survey conducted by CoreData for the period of 1 July 2013 to 30 June 2015, which gathered data from 2.4 million loan contracts under $2,000 found small loans are typically paid back in 4 months.

Therefore APR calculations don’t work for SACCs or small loans less than 12 months.

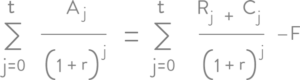

Here is only part of the formula to calculate APR. Confused?

So you can see, calculating the APR of a SACC or small loan is confusing, misleading and deceptive because it will never tell the consumer the true cost of their loan.

What borrowers WANT TO KNOW and what WILL WORK for consumers of SACCs or small loans is being told:

- How much the loan will COST them (the cost is the fees and charges)

- What the weekly/fortnightly/monthly repayment amount will be

- How many repayments will be needed

- How much they will have to repay in total (the original loan amount plus the fees and charges)

When lenders tell their borrowers in a clear and understandable language, a consumer can fully understand what they need to pay and when, so they can successfully repay their loan.

Do other industries use annual rates for their products and services?

If you compare annual rates in other industries, you’ll get the picture. The hotel and parking sectors don’t advertise an annual rate for their services. Imagine if consumers were quoted annual rates when paying for HOTEL ROOMS? Instead of $195 per night it would be $71,175 per annum. What if consumers were quoted annual rates when paying for PARKING? Instead of $13 per hour it would be $113,880 per annum.

APR is a meaningless measurement in these industries as well as for SACCs or small loans. That’s why NCPA is calling for the government to ban APRs being quoted for loans under 12 months.

APR is a meaningless measurement in these industries as well as for SACCs or small loans. That’s why NCPA is calling for the government to ban APRs being quoted for loans under 12 months.